KBL ONE Corporate Internet Banking

Elevate your enterprise's financial management with our business offering. Embrace a world where seamless transactions, comprehensive account oversight, and state-of-the-art security converge, offering your business the ultimate banking convenience and efficiency. Available 24/7.

Our best features

An intuitive and modern banking platform for your business

Access corporate internet banking instantly, without delays or complex procedures

Simplified GST payments, integrating your tax needs with banking

Efficient bulk file uploads for NEFT, RTGS, and intra-bank transactions

Unlock the full potential of Internet banking

Simplifying KBL ONE Corporate with tips and tricks

Got questions? We've got answers.

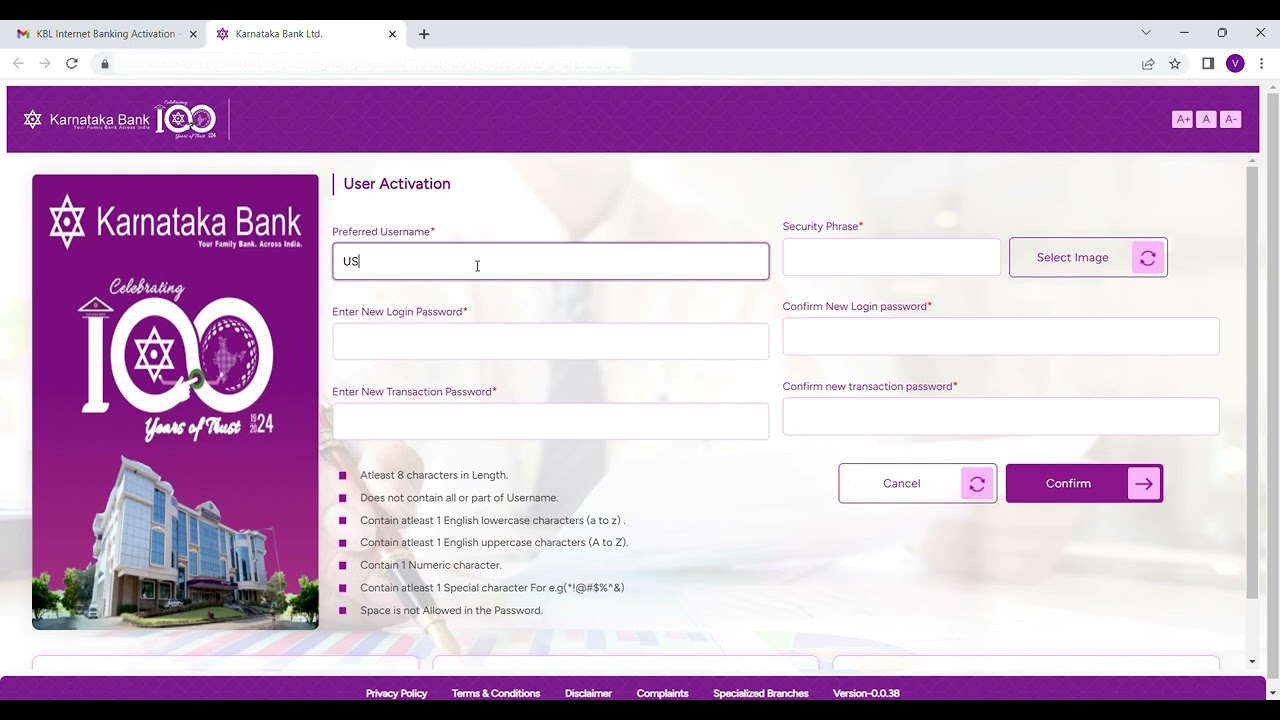

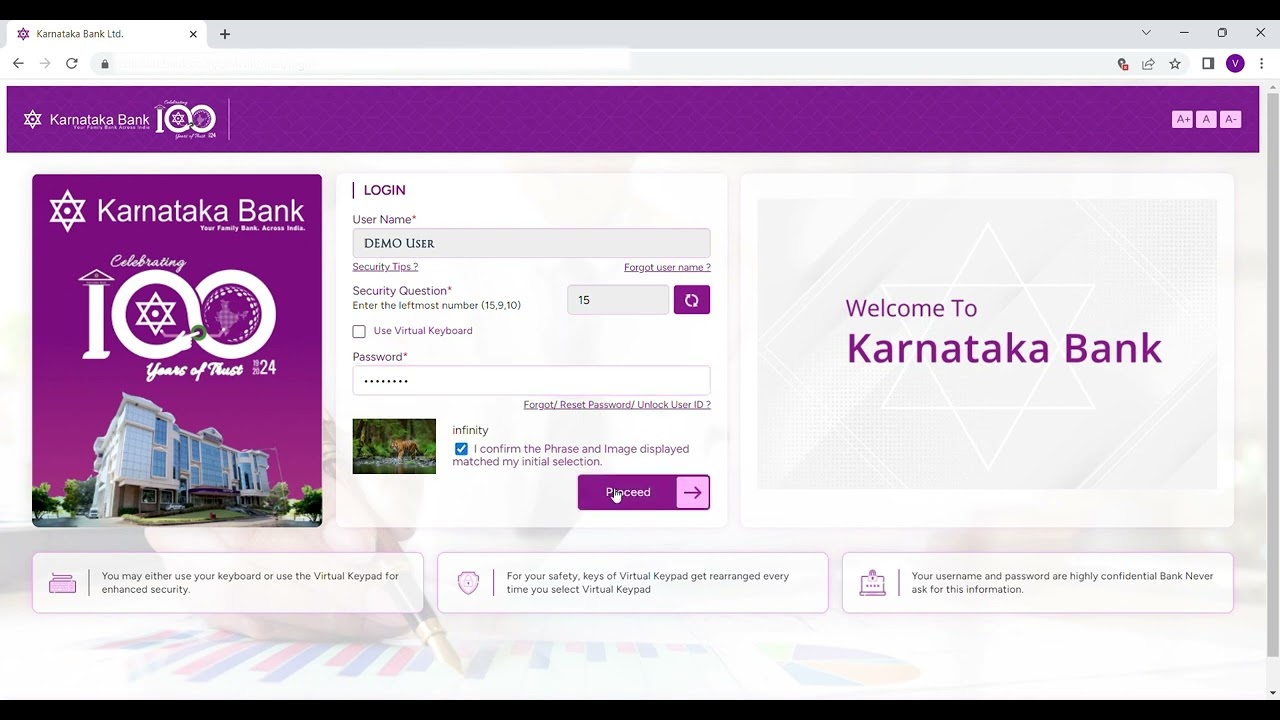

Visit Karnataka Bank’s website, select KBL ONE under Corporate Internet Banking, and register your corporate account. The activation is instant, and you'll be guided through setting up your login credentials.

KBL ONE employs advanced security measures, including the latest encryption technologies, to safeguard your financial data. This ensures all your transactions and sensitive information remain secure.

Yes, with KBL ONE, you can make quick transfers up to Rs.50,000 instantly without the need to add beneficiaries, streamlining your transaction process.

The platform allows for single bulk file uploads for various transaction modes like NEFT, RTGS, and within bank transfers, enhancing efficiency for corporate banking needs.

KBL ONE integrates your GST payment needs with your banking operations, allowing you to handle these payments directly through the platform.

Yes, KBL ONE offers functionalities to view cheque status and issue stop cheque instructions, giving you greater control over your cheque transactions.